The response to Covid-19 has seen businesses adapt to a new way of working, where safeguarding the health of clients and staff is of paramount importance. A secondary, but no less important task, is to ensure that jobs are protected so that following this unprecedented time businesses and their employees can return to function.

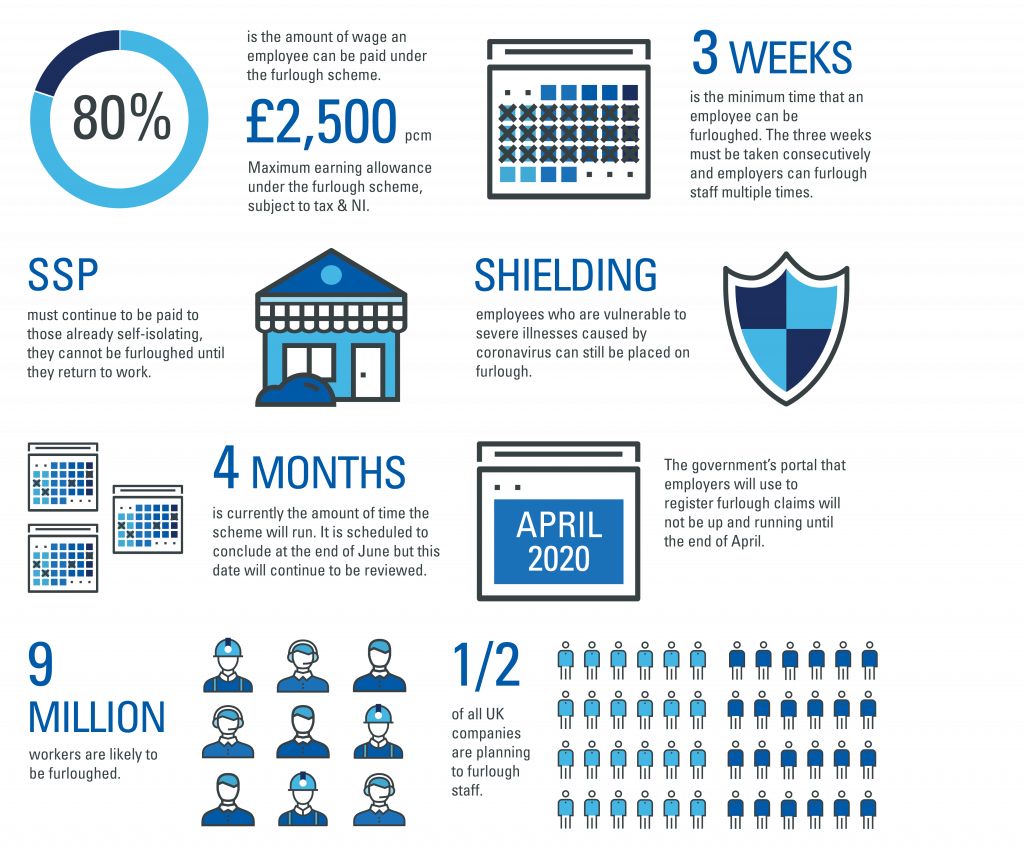

Many employers, who have been negatively impacted by Covid-19, find they are unable to cover regular staff wages. Instead of making redundancies employees can be temporarily furloughed and through the “Coronavirus Job Retention Scheme” paid 80% of their regular salary (capped at £2,500 pcm).

Anyone working in a full-time job (or on a PAYE basis) on March 19th 2020 can be furloughed. This includes people on zero hours contracts or those working flexibly. Someone is ‘furloughed’ if they remain employed but are not undertaking work.

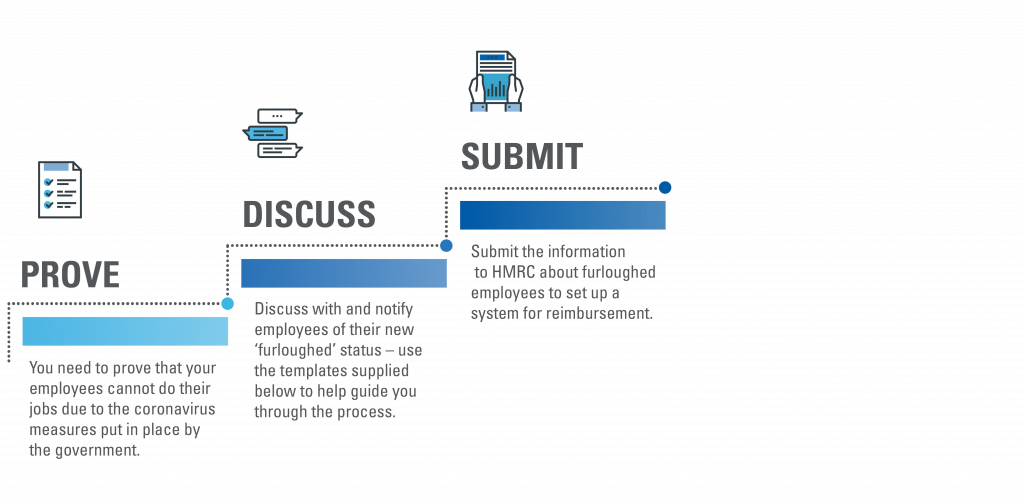

Find out whether you are eligible to claim furlough for your employees in 3 simple steps:

Furlough Key Facts

Both businesses and employees should understand what the correct process is for furlough to be invoked, and what it means for them. To help, Tysers Risk Services have provided some useful guidance documents for clients to download.

Seeking Agreement to Furlough Employees Template

Imposing period of Furlough Working Letter Template

Useful additional helpful links for you and your employees here

Click here to find out how to claim.

" alt="Forced to Furlough?">

" alt="Forced to Furlough?">